Article - What is the Value of Project Portfolio Management?

Submitted by Jamal Moustafaev on Sat, 03/21/2015 - 11:27

To develop or maintain a competitive advantage in the marketplace it is common practice to evaluate the actions of industry leaders if possible. Although we have discussed this thing called “project portfolio management” on this website numerous times, let us look at some historical data collected during two independent studies comparing the actions of industry leaders against the laggards*.

The first study that we will review attempted to answer the following question “Is there a systematic relationship between sound project portfolio management technique usage and the financial success of companies”.

The study included 205 businesses with an average of $6.4 billion in annual sales. The breakdown of the respondents by industry was:

- High technology – 17.6%

- Processed materials – 8.3%

- Industrial products – 8.3%

- Chemicals and advanced materials – 26.3%

- Healthcare products – 6.3%

- Others – 19.0%

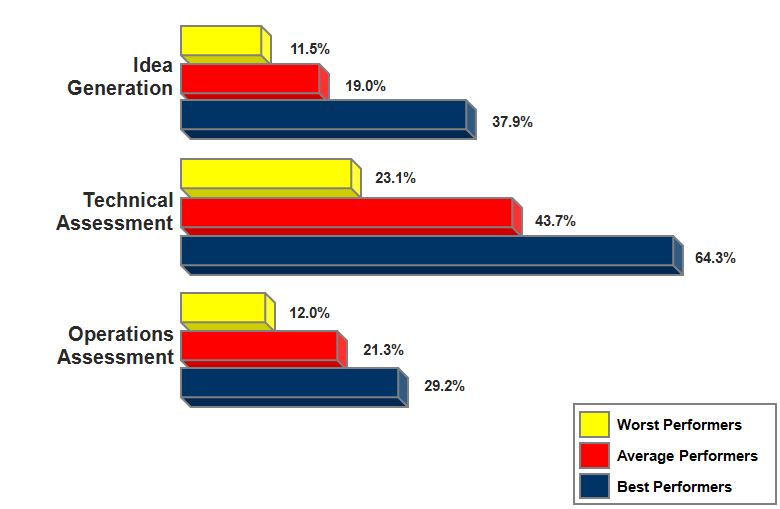

At the time of this study 37.9% of the leaders had an institutionalized approach for idea generation in their organizations compared only to 11.5% of the worst performers. Also, almost 65% of the best performers conducted technical assessments of their projects. Only 23% of the worst performers did that (see Figure 1).

Figure 1

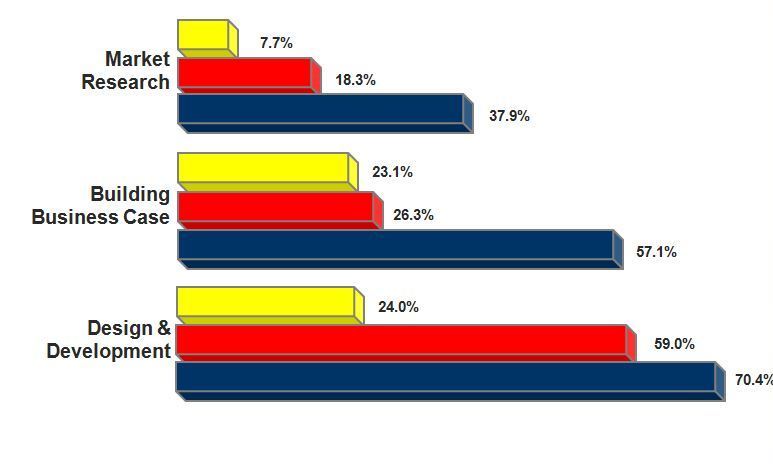

By the same token market research preceding the project approval was undertaken by almost 38% of leading organizations. Merely 7.7% of the worst-performing companies assessed market conditions before project approval (see Figure 2).

Figure 2

Business cases required for the project proposals assessment and approval were built by 57% of the industry leading firms. Just 23% of the worst performers invested time and effort into proper project proposal analysis.

Almost 45% of the leaders investigated product performance after the completion of the project, whereas only 7.7% of the worst-performing organizations researched whether the products they created had indeed performed as well as the initial forecasts (see Figure 3).

Figure 3