Introduction

In my consulting and training engagements I frequently get to have interesting discussions with executives and senior managers from around the world. Obviously, considering the nature of my professional domain, the conversations we have regularly revolve around the topic of project portfolio management. They ask me very interesting and difficult questions, and I have to provide them with clear and succinct answers.

After several years of doing this, I suddenly noticed that no matter what industry the company belongs to, of where (geographically) the conversation takes place, I always end up answering the same questions over and over again.

So I decided to come up with a series of articles "The CEO's Guide to Project Portfolio Management - Frequently Asked Questions Answered" that will span across several posts. Check out Part 1, Part 2 and Part 3 of the series.

P.S. If there are any people out there who want to submit their own PPM-related questions, do not hesitate contacting me by leaving a comment here or sending an e-mail to info@thinktankconsulting.ca

Question #6 - What About the Proverbial Gut Feel?

I remember a case when I was teaching my project portfolio management workshop at a very large German company, when one of the course attendees who happened to be a director of the clean energy department asked me the following question:

"Yes, I understand the scoring model concept and I think is very useful. But what about the project candidates that score very low, but you still have an inner belief that this could be the next big hit? What about the proverbial gut feel?"

A very popular way to circumvent this problem is to introduce the “joker project” concept. This methodology allows placing the project candidate at the very top of the rank-ordered list of project proposals even if it scores very low in the current company’s scoring model.

Sometimes there comes a proposal across the steering committees table that scores very low across almost all of the scoring criteria and yet the key decision makers feel that this is a very important and valuable initiative that can become the next breakthrough project that would generate millions if not billions of dollars for their company. Or alternatively, if the project is not implemented, there is a likelihood that an organization would not be able to operate in a couple of years.

Here is an example of a need for a joker project was encountered by me at one small North American university. One of the project proposals raised by the executive board recommended an upgrade of the university’s student information system that included modules like student information management, online learning, assessment development and analysis, curriculum mapping, special education, and finance and human resources. At the time of this conversation the “university ERP platform”, as it was often referred to by the organization’s employees had not been upgraded for nine years and, as a result, has been slowly crumbling, causing more and more problems as the time went by.

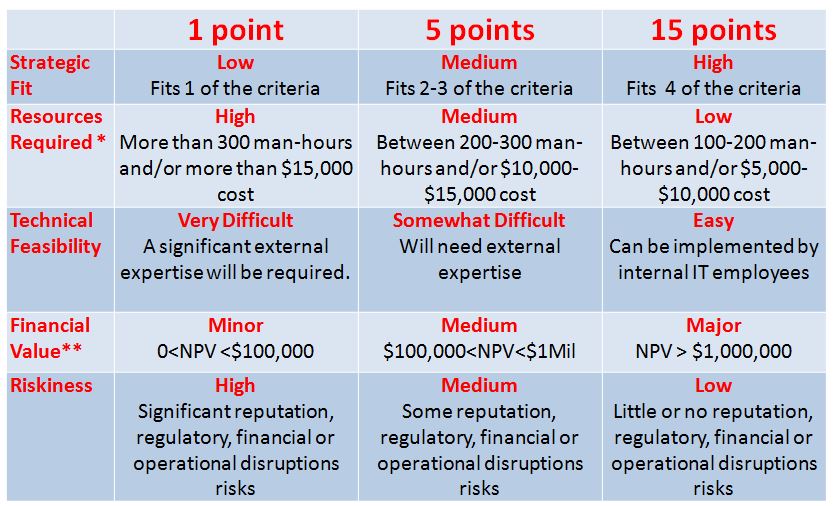

Organizational scoring model looked like this (see also Figure 1):

- Strategic Fit (included components like attracting more local and international students, improving university reputation locally and internationally, providing the best possible mix of services and benefits to students and employees and increasing the social value of programs and initiatives undertaken)

- Resources Required (the less resources are need, the more attractive is the project)

- Technical Feasibility (the more external resources are required, the less attractive is the project)

- Financial Value (either revenue generation or cost savings)

- Riskiness (included reputation, regulatory, financial or operational disruptions risks)

Figure 1

How did the proposed project score in each one of the above categories?

- Strategic Fit – very low, no impact whatsoever on attracting students, improving reputation or increasing the social value, although one can argue that it helps to improve the mix of services and benefits

- Resources Required – very low, as the project in question was expected to be the largest ever the university has ever undertaken

- Technical Feasibility – very low, since most of the resources on that project had to be external

- Riskiness – again, very low score, because the project would have exposed the school to all of the risks listed including reputation, regulatory, financial or operational disruptions.

Interestingly enough despite its alarmingly low score the project received an approval from the executive committee for one simple reason: the university would have ceased to function if this issue remained unattended for another year or two.

What can be said at the end of this section? The joker power should be used sparingly and only for the projects that are of extreme importance for the organization. They usually fall into one of the two categories: business continuity or the next great breakthrough project that will change the fortunes of the company. In either case the responsibility for the project success or failure will rest on the shoulders of the executive committee.

About the Author

Jamal Moustafaev, MBA, PMP – president and founder of Thinktank Consulting is an internationally acclaimed expert and speaker in the areas of project/portfolio management, scope definition, process improvement and corporate training. Jamal Moustafaev has done work for private-sector companies and government organizations in Canada, US, Asia, Europe and Middle East. Read Jamal’s Blog @ www.thinktankconsulting.ca

- If you have a Twitter account, please follow Jamal there: https://twitter.com/ThinktankConsul

- Like our page on Facebook: https://www.facebook.com/projectmanagementthinktankconsulting

- Connect with me on LinkedIn: https://www.linkedin.com/in/jmoustafaev

- Subscribe to my RSS feed: http://www.thinktankconsulting.ca/rss.xml

Jamal is an author of two very popular books: Delivering Exceptional Project Results: A Practical Guide to Project Selection, Scoping, Estimation and Management and Project Scope Management: A Practical Guide to Requirements for Engineering, Product, Construction, IT and Enterprise Projects.