Introduction

In my consulting and training engagements I frequently get to have interesting discussions with executives and senior managers from around the world. Obviously, considering the nature of my professional domain, the conversations we have regularly revolve around the topic of project portfolio management. They ask me very interesting and difficult questions, and I have to provide them with clear and succinct answers.

After several years of doing this, I suddenly noticed that no matter what industry the company belongs to, of where (geographically) the conversation takes place, I always end up answering the same questions over and over again.

So I decided to come up with a series of articles "The CEO's Guide to Project Portfolio Management - Frequently Asked Questions Answered" that will span across several posts.

P.S. If there are any people out there who want to submit their own PPM-related questions, do not hesitate contacting me by leaving a comment here or sending an e-mail to info@thinktankconsulting.ca

Question #1 - What is Project Portfolio Management?

One of my favorite definitions of project portfolio management states the following:

Project portfolio management is the management of the organization’s projects so as to maximize the contribution of projects to the overall welfare and success of the enterprise subject to internal and external constraints by maximizing the project value, balancing the portfolio and aligning it with overall company strategy.

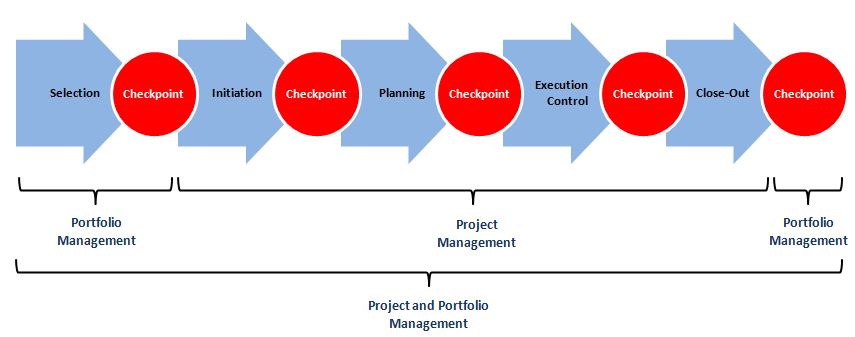

Figure 1 demonstrates the proper flow of the project in the project and portfolio management lifecycle. Initially someone at the company must come up with a project idea. That person should assess her initiative from three aspects: project value, desired portfolio balance and strategic alignment and capture all of this information in a business case.

Figure 1

The business case is then submitted to the portfolio selection committee whose mandate is to re-evaluate the project according to the approved company’s scoring model, portfolio balance requirements and strategic alignment prerequisites. If the project is approved, the project manager is assigned and from this point of time both project management and project portfolio management run concurrently. The “job” of the project management is to ensure that the project is delivered on-time, on-budget and with the least amount of defects, while the “responsibility” of project portfolio management is to verify at the end of each stage that the assumptions made about project value, balance and strategic fit are still true.

Question #2 - What Exactly is Value, Balance and Strategic Alignment?

One can say that project portfolio management rests on three pillars:

- Projects selected must maximize the value for the company

- Projects selected must constitute a balanced portfolio and

- The final portfolio of projects must be strategically aligned with the company’s overall business strategy

Initially many organizations assessed the value of their projects by directly borrowing the portfolio model from the financial industry. In other words, they analyzed the value of their projects based solely on the financial factors such as net present value (NPV), return on investment (ROI), internal rate of return (IRR) and many others. However, soon it was realized that despite their obvious benefits – companies are in business to make money – these models had two major drawbacks: notorious unreliability of financial forecasts and the fact that these models were ignoring other important factors, such as strategic fit, marketability, resource requirements, risk, etc.

Eventually the most forward-thinking organizations switched to scoring models that included several factors in order to define and assess the value of their proposed projects. Here is a couple of examples of such models.

A software product company operating in the e-commerce market has developed the following fairly aggressive scoring matrix:

- Product and Competitive Advantage

- Market Attractiveness

- Leverage of Core Competencies

- Technical Feasibility and

- Financial Reward

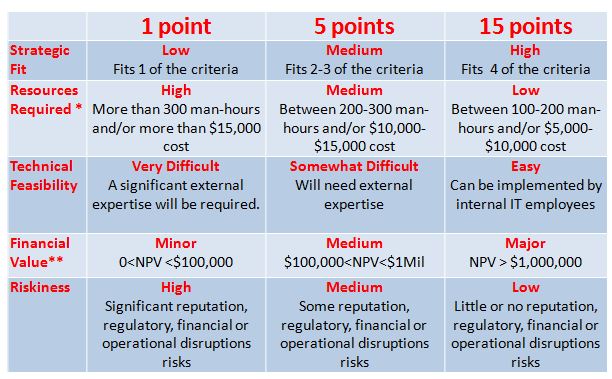

On the other hand a smaller North American university had a more conservative approach to project selection. Their factors included (see also Figure 2):

- Strategic Fit

- Resources Required

- Technical Feasibility

- Financial Value and

- Riskiness

Figure 2

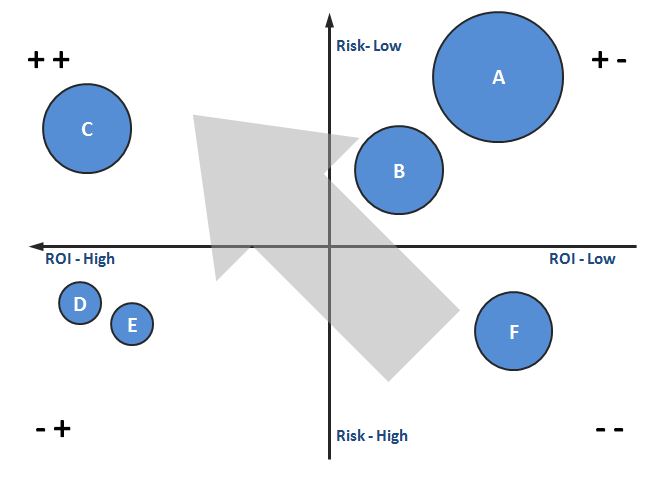

The second pillar of project portfolio management is the balance of the portfolio. It is usually assessed using two dimensional graphs with different values attached to the vertical and horizontal axis. One of the most popular pairs is the project risk and the project’s financial reward (see Figure 3).

In this particular model we can see that a company has projects A and B located in the low-risk, low-reward quadrant, while project C is in the low-risk, high-reward zone. Two smaller ventures D and E are positioned in the high-risk, high-reward section of the graph and, finally, medium sized project F is in the high-risk, low reward zone.

Figure 3

The definition of portfolio’s strategic alignment is fairly simple and straightforward: all of your projects must in one form or another assist the implementation of your company’s strategy. A very simple statement that at times is very difficult to explain. In order to do that, let us examine an example of the project alignment, or to be more precise, of project non-alignment.

At one point of time the executives of Société Bic (commonly referred to just as Bic), a French disposable consumer products company known for their razors, lighters, ballpoint pens and magnets made a very interesting decision. The company decided to enter … the ladies underwear market by designing, producing and selling among other things ladies pantyhose. Needless to say the company failed miserably with this project since the consumers were unable to see any link between Bic’s other products and underwear, because of course there was no link at all.

Although, as the urban saying goes “hindsight is 20/20” let us nevertheless try to assess this initiative from the strategic alignment perspective. Here is a list of potential questions one could direct at the Bic executives who proposed to add this project to the company portfolio:

- We manufacture disposable products made from plastic. What the heck do we know about ladies underwear?

- All of our production facilities are built based on the injection-molded plastic technology? Where will we get the equipment to manufacture underwear?

- People, especially females, perceive us as producers of cheap disposable lighters and pen? Would they be interested in purchasing our lingerie products?

- What about the distribution channels? Retail outlets that trade disposable razors, pens and lighters usually do not sell underwear. Does this mean we will have to acquire a brand new group of retail channels?

It is obvious that none of the answers to the above questions were very encouraging had they been asked at the time of project initiation. Indeed, there was little or no alignment between the proposed endeavor and the overall company strategy.

About the Author

Jamal Moustafaev, MBA, PMP – president and founder of Thinktank Consulting is an internationally acclaimed expert and speaker in the areas of project/portfolio management, scope definition, process improvement and corporate training. Jamal Moustafaev has done work for private-sector companies and government organizations in Canada, US, Asia, Europe and Middle East. Read Jamal’s Blog @ www.thinktankconsulting.ca

- If you have a Twitter account, please follow Jamal there: https://twitter.com/ThinktankConsul

- Like our page on Facebook: https://www.facebook.com/projectmanagementthinktankconsulting

- Connect with me on LinkedIn: https://www.linkedin.com/in/jmoustafaev

- Subscribe to my RSS feed: http://www.thinktankconsulting.ca/rss.xml

Jamal is an author of two very popular books: Delivering Exceptional Project Results: A Practical Guide to Project Selection, Scoping, Estimation and Management and Project Scope Management: A Practical Guide to Requirements for Engineering, Product, Construction, IT and Enterprise Projects.